San Francisco Housing Market: A Q4 2024 Review

The San Francisco housing market, as measured by the Case-Shiller index for Q4 2024, reveals a story of modest growth and potential stabilization. While not a dramatic surge, the slight price increase signals a potential shift away from the volatility of previous years. This review analyzes the key factors influencing this trend, offering actionable insights for various stakeholders and assessing the risks and regulatory implications shaping the future of San Francisco real estate. Understanding these dynamics is crucial for both homeowners and investors navigating this complex market.

Detailed Analysis: Unpacking the Case-Shiller Index

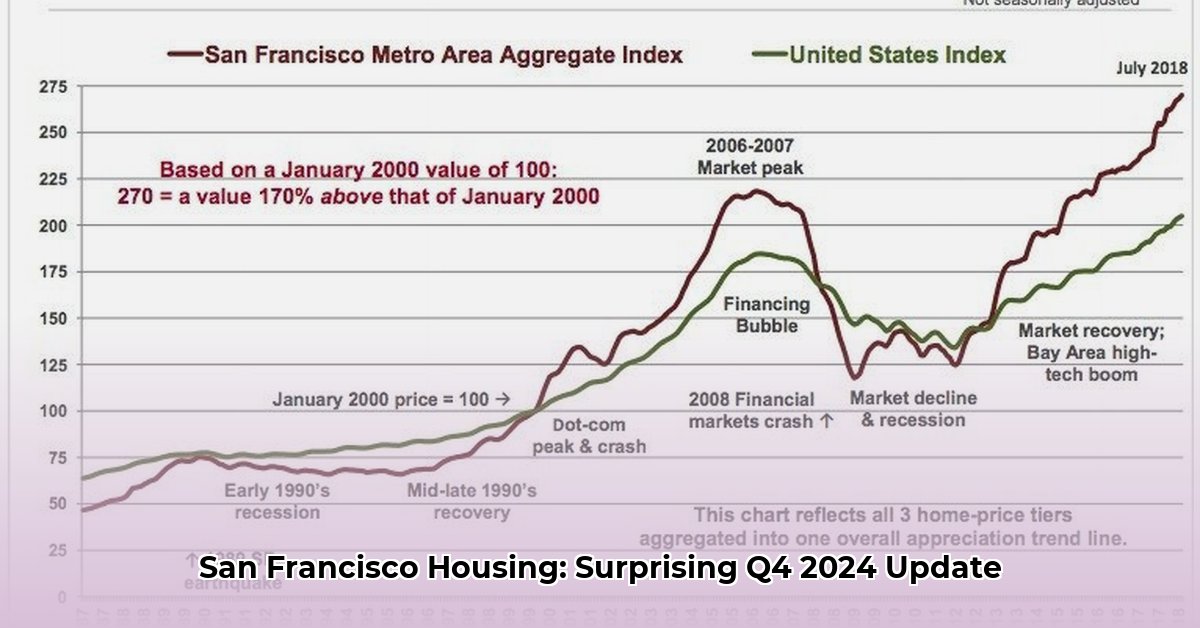

The Case-Shiller index is a widely recognized measure of home price fluctuations, providing a valuable perspective on market trends. By tracking the sale prices of the same homes over time, it smooths out short-term price fluctuations, giving a clearer picture of long-term trends. Data from sources like the Federal Reserve Economic Data (FRED) and YCharts show a modest year-over-year increase in the San Francisco Case-Shiller index during Q4 2024 (precise figures vary slightly across data sources due to differences in methodologies and data sets). [Insert chart/graph visualizing the trend from FRED, YCharts data here]. While minor discrepancies exist, the overall trend toward modest growth remains consistent.

Several factors contribute to this measured growth. Interest rate hikes have cooled buyer demand, impacting affordability. The limited housing inventory in San Francisco further contributes to price support. Finally, broader economic uncertainties have introduced a degree of caution into the market. The interplay of these factors creates a more balanced market compared to the rapid price escalations witnessed previously. This represents a departure from the prior period of sustained, significant increases in home prices.

Actionable Insights: Navigating the Market

The current market conditions present both opportunities and challenges for various stakeholders. Let's explore actionable strategies:

Homebuyers: Prospective buyers should closely monitor interest rate trends. Rising rates directly impact borrowing capacity. Thorough budgeting and exploring diverse financing options are crucial. Furthermore, carefully research neighborhood trends and prioritize those offering long-term value. Don't rush into a purchase; take advantage of the potentially slower pace of price appreciation to make informed choices.

Home Sellers: While the market shows signs of stabilization, sellers need to price their homes competitively, referencing recent sales in their neighborhood. A professional presentation of the property is crucial in attracting buyers. Adaptability is key in this ever-shifting market. Having a contingency plan is beneficial in case of unexpected shifts in buyer demand.

Real Estate Agents: A deep understanding of local market nuances is paramount. Agents should focus on building expertise in specific micro-markets within San Francisco, identifying unique neighborhood trends and catering to highly-specific needs. Continuing education and skills development are crucial for staying ahead of market changes.

Investors: Real estate investments require a thorough risk assessment. Diversification through various assets, both within and outside of real estate, is essential. This mitigates the impact of potential market downturns. Focusing on properties with robust rental potential is a key strategy for generating income and mitigating some risk.

Local Government: Addressing affordability remains a key priority. Strategies to increase the housing supply, such as streamlining the building permit process and fostering the development of more affordable housing options, are critical. Continuing to implement policies that promote sustainable and inclusive growth in the housing sector is essential.

Risk Assessment & Regulatory Implications

Several key risks affect the San Francisco housing market's outlook. Increased interest rates can significantly impact affordability and buyer demand. A broader economic downturn poses a threat to market stability. Unexpected regulatory shifts, including changes to zoning laws or property tax policies, can dramatically affect market conditions. Mitigating these risks requires constant monitoring of economic indicators and a close eye on legislative developments.

Conclusion: A Measured Outlook for San Francisco Real Estate

The Q4 2024 Case-Shiller index data for San Francisco points toward a market showing signs of moderation and potential stabilization. While modest growth is evident, various factors—interest rates, inventory levels, and overall economic conditions—continue to influence the market's trajectory. Proactive monitoring, adaptability, and a nuanced understanding of market dynamics are crucial for success in this evolving environment. While the current phase suggests a period of measured growth, continued vigilance remains paramount.